Vidit Sidana

With 18 billion+ transactions happening on UPI every month in India, the National Payments Corporation of India (NPCI) has truly changed how all of us pay digitally! There is no better time than right now to continuously innovate and leverage the existing UPI ecosystem.

And this is where eRUPI comes into the picture. Let us try to understand how your business spends can come on UPI through these UPI Vouchers called eRUPI!

These are prepaid digital UPI vouchers that can be issued to specific people with the spend use-case locked at a Merchant level for each beneficiary.

Imagine Direct Benefit Transfer (DBT) done for any government scheme but onto the beneficiary’s UPI app directly with the spend case locked for the scheme’s intended purpose only! Just like how DBT eliminated the need of middlemen for subside disbursement by the subsidy amount being directly debited into the beneficiary’s bank account, eRUPI takes it a step ahead by also locking the use-case for which the intended spend is supposed to be done!

So if a beneficiary was to get Rs. 2,000 for Girl child education, the amount will go to the beneficiary’s mobile number on UPI with the spend being locked at Schools/Books/Uniform outlets. The beneficiary can scan the existing merchant code at these outlets and pay using their existing UPI app using these UPI-enabled digital vouchers called eRUPI!

However, there is limited public awareness of this new payment instrument. The first thing that comes to our mind when we hear the term eRUPI is something to do with digital currency but that is eRupee or Central Bank Digital Currency (CBDC), a digital rupee network launched by multiple banks, which is different from eRUPI that we are talking about.

For most Indians, UPI is the mode of payment that all of us use to make our payments and since eRUPI is nothing but prepaid digital vouchers that run on UPI, it is bound to become the new form of payment instrument!

This is exactly where Cotodel comes into the picture as we intend to solve for your business expenses. We want to make your business payments as seamless as your personal UPI spends

18 billion UPI transactions are happening every month! Time to get your Business payments on UPI as well?

UPI vouchers leverage the existing UPI ecosystem with no change in consumer or merchant behaviour, making the learning curve almost non-existent for any type of user!

Here is how a business can issue these UPI vouchers for their targeted business spends:

1. Onboard & sign-up your business with Cotodel.

2. Add your employees’ mobile numbers to onboard them. No separate KYC is needed for each employee.

3. Define Voucher amount, Validity & Purpose of Spend (let us assume Fuel for this example)

4. The total voucher amount gets blocked in the Company’s Bank Account and does not get transferred to each employee’s account on issuance.

5. Employee receives the voucher on their existing UPI app, which is linked to their mobile number.

6. Employee activates the voucher from the UPI app of their choice, which they are already using, without downloading any new app.

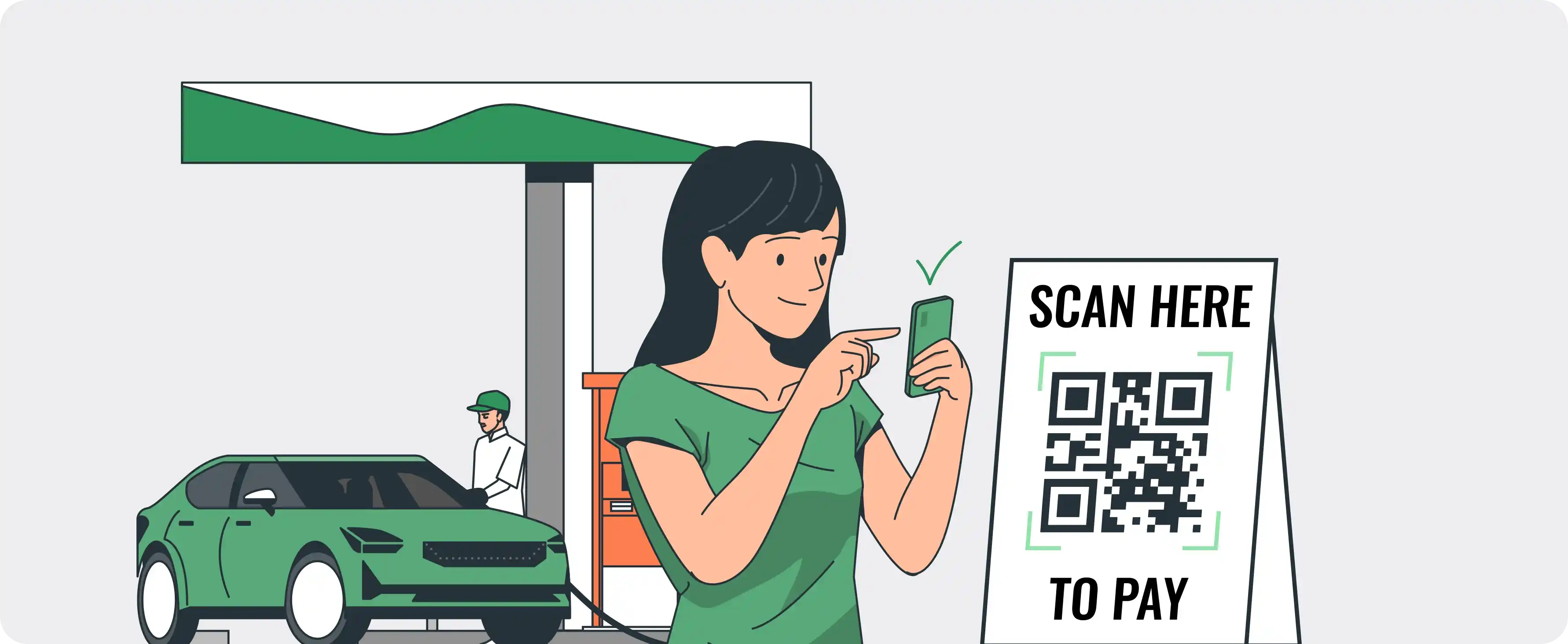

7. The employee goes to the Petrol pump and scans the UPI QR code, which is already installed at the fuel station.

8. Fuel voucher automatically pops up right below the employee’s bank account on their UPI app, without them having to enter or find any gift coupon/code.

9. The employee can then select the Fuel Voucher instead of their Bank Account and pay using the same, just like how they complete a regular UPI transaction.

10. Once the employee enters the UPI Pin and transaction is successful, then the transaction amount gets deducted from the Company’s Bank Account and it is a direct debit transaction for the merchant.

11. Complete Digital trail for reconciliation is provided to Cotodel’s clients through the Dashboard, helping them track and monitor the expenses being done by their employees.

Time to start going digital on UPI through vouchers as well now!