Shreya Garg

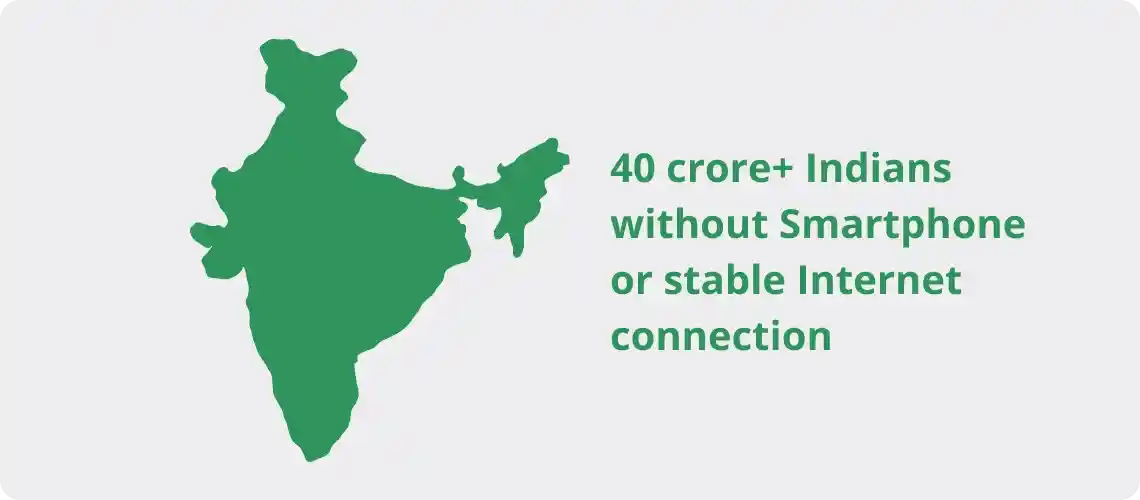

In a country as diverse and vast as India, financial inclusion means more than just having a bank account. It’s about making digital transactions accessible to everyone—including the 40 crore+ Indians who use feature phones and may not have reliable internet connectivity.

That’s where UPI 123Pay, introduced by the National Payments Corporation of India (NPCI), steps in. Designed to bridge the digital divide, this innovation ensures that even users with basic phones can make secure, real-time UPI payments

Let us try to understand how UPI 123Pay can allow you to do your digital transactions without internet or without a smartphone!

UPI 123Pay is a revolutionary platform that allows users without smartphones or internet access to send and receive money using Unified Payments Interface (UPI). Unlike traditional UPI, which needs internet-enabled apps, UPI 123Pay uses alternative methods—voice calls, missed calls, apps for feature phones, and proximity sound-based payments—to enable financial transactions.

This is a major step toward financial empowerment and digital inclusivity for rural and under-served Indian population and can also be implemented globally to bring more people to the digital financial inclusivity circle.

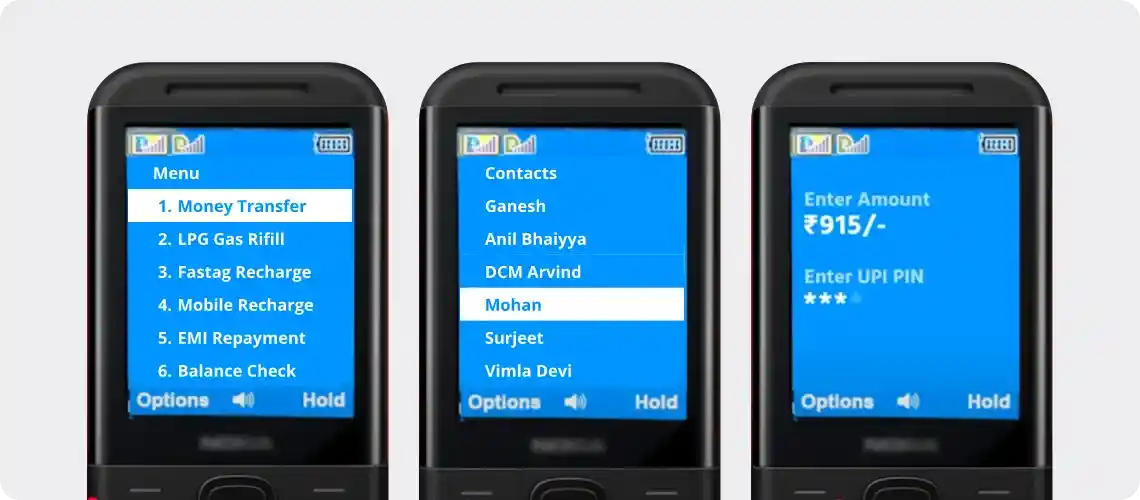

UPI 123Pay offers four simple ways to make or receive payments:

1. IVR (Interactive Voice Response): Call a dedicated number, follow voice prompts to make payments using contact numbers and UPI PIN.

2. Missed Call Service:Give a missed call to a specific number, then follow up via incoming call to complete a transaction.

3. App-based Payments:Lightweight apps built for feature phones support UPI transactions without internet access..

4. Proximity Sound-based Payments:The proximity sound-based payment solution, allows users to make contactless UPI payments to merchants. Users call the IVR number, choose Pay to Merchant, tap their phone on the merchant's device (Sound Box), press # upon hearing the unique tone, enter the payment amount and UPI PIN, and complete the transaction.

Each method is secure, user-friendly, and does not require high-end technology—just a working mobile connection and basic phone is all that is needed to do a UPI transaction.

18 billion UPI transactions are happening every month! Time to get your Business payments on UPI as well?

Getting started is quick:

1. Dial the dedicated UPI IVR number (e.g., 08045163666).

2. Choose your language and follow instructions.

3. Select the service—money transfer, balance check, etc.

4. Enter details and UPI PIN for verification.

No internet. No apps. Just access and ease.

Let’s say Rajesh wants to send ₹500 to his friend Mohan via UPI 123Pay

1. Calls the UPI 123Pay IVR number

2. Selects “Money Transfer” from the voice menu.

3. Chooses “Mohan” from saved contacts.

4. Enters the amount and authenticates using his UPI PIN.

And just like that—Rajesh has completed a secure UPI payment without needing the internet or a smartphone!

This means more people can participate in the digital economy comfortably and securely with UPI 123Pay.

UPI 123Pay is a powerful innovation that breaks barriers and builds bridges—connecting millions of offline users to the world of digital payments. It ensures that financial empowerment is not limited by devices or connectivity.