Shreya Garg

In an era of digital transactions, managing payments securely and efficiently is crucial. The National Payments Corporation of India (NPCI) introduced UPI Circle to simplify payment delegation while ensuring complete control and security. With this feature, users can authorize trusted individuals to make transactions on their behalf while maintaining oversight of payments being done done.

Read on to discover how UPI Circle can make your financial transactions more seamless and secure!

UPI Circle is a feature that enables a primary user to delegate payment rights to a trusted secondary user within predefined limits. This means you can authorize a family member, staff, or assistant to make payments while keeping control over transaction limits and security.

For example, you can allow your child, domestic help, or office assistant to handle certain payments without directly giving them access to your bank account. UPI Circle makes this possible with built-in security measures such as biometric authentication and UPI PIN verification.

Additionally, UPI Circle is designed to be user-friendly, requiring minimal setup. Users can activate this feature through their preferred UPI-enabled app and configure delegation settings within minutes.

1. Add Up to 5 Secondary Users: A Primary user can delegate payment rights to a maximum of five trusted individuals. However, a Secondary user can accept delegation from only one Primary user.

2. Secure Transactions with Bio-metric & UPI PIN: Every transaction made by a Secondary user requires bio-metric authentication or UPI PIN verification, ensuring security of the transaction.

3. Real-time Transaction Alerts: The Primary user receives live updates on all transactions, ensuring transparency and control.

4. Flexible Delegation Options: Primary user can choose if they want to give each Secondary user Full Delegation or Partial Delegation for transactions.

5. Transaction Limits for Security: The system ensures that delegated transactions remain within safe limits—up to ₹5,000 per transaction and ₹15,000 per month for full delegation.

6. Works Across Multiple Payment Scenarios: Whether it's managing household expenses, helping elderly parents, or handling team finances in a business setup, UPI Circle caters to various real-world needs.

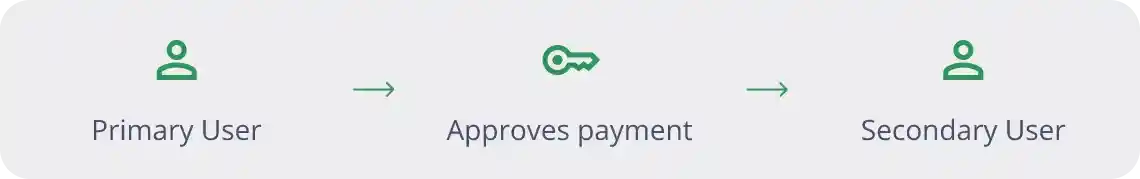

Full Delegation: The secondary user can make transactions up to ₹5,000 per transaction and ₹15,000 per month without requiring further approval.

Partial Delegation: The secondary user must send a payment request to the primary user, who then approves the transaction by entering their UPI PIN.

18 billion UPI transactions are happening every month! Time to get your Business payments on UPI as well?

UPI Circle is perfect for scenarios where controlled payment delegation is needed. Here’s how it can help:

1. Open your UPI-enabled app (BHIM, Google Pay, PhonePe, Paytm, etc.).

2. Navigate to the UPI Circle section in the app settings.

3. Add a secondary user by entering their UPI ID or registered mobile number.

4. Set delegation type (Full or Partial) and define transaction limits.

5. Authenticate the setup using bio-metric verification or UPI PIN.

UPI Circle is revolutionizing delegated payments by offering a secure, flexible, and transparent way to authorize transactions. Whether you want to manage household expenses, assist family members, or handle office expenditures, UPI Circle ensures peace of mind while keeping financial control in your hands.

With its seamless activation process, built-in security features, and real-time tracking, UPI Circle is a smart solution for modern digital payments.