Shreya Garg

In a world driven by convenience and speed, The National Payments Corporation of India (NPCI) Introduced UPI Lite in September 2022 that simplifies small value transactions to make everyday payments quicker, more seamless and independent of internet Connectivity.

Let us try to understand how UPI Lite can make your digital transactions even easier!

60% of future transactions will be under INR 200, according to the NPCI's UPI Lite product handbook. The UPI LITE solution was developed to handle low value transactions without a UPI Pin in order to handle this growth in low value transactions and lessen the strain on bank infrastructure. This will also assist NPCI in achieving its target of one-billion-a-day transactions in the UPI environment.

Activating UPI Lite on your phone is a simple and quick process. To begin, open your preferred UPI-enabled app, such as Google Pay, PhonePe, Paytm, or BHIM, and ensure that it is updated to the latest version. Then, navigate to the app's settings or payments section, where you will find the option to enable UPI Lite. You can then add funds to your UPI Lite wallet directly from your linked bank account to start transacting via UPI Lite.

This entire process typically takes just 2-3 minutes, allowing you to instantly start making small-value transactions. Additionally, UPI Lite activation does not require any KYC process, making it even more accessible and convenient for users.

18 billion UPI transactions are happening every month! Time to get your Business payments on UPI as well?

UPI Lite is a revolutionary payment feature for everyday payments. Here’s why UPI Lite is becoming the go-to option for seamless and hassle-free transactions:

1. Offline Payments: One of the standout features of UPI Lite is its ability to function without an internet connection. This makes UPI payments possible even in areas with low/limited internet connection.

2. No Cap on Transactions Per Day:UPI Lite allows users to perform an unlimited number of small-value transactions throughout the day.

3. No UPI PIN for Small Transactions:Forget the hassle of entering your UPI PIN every time you make a small payment.

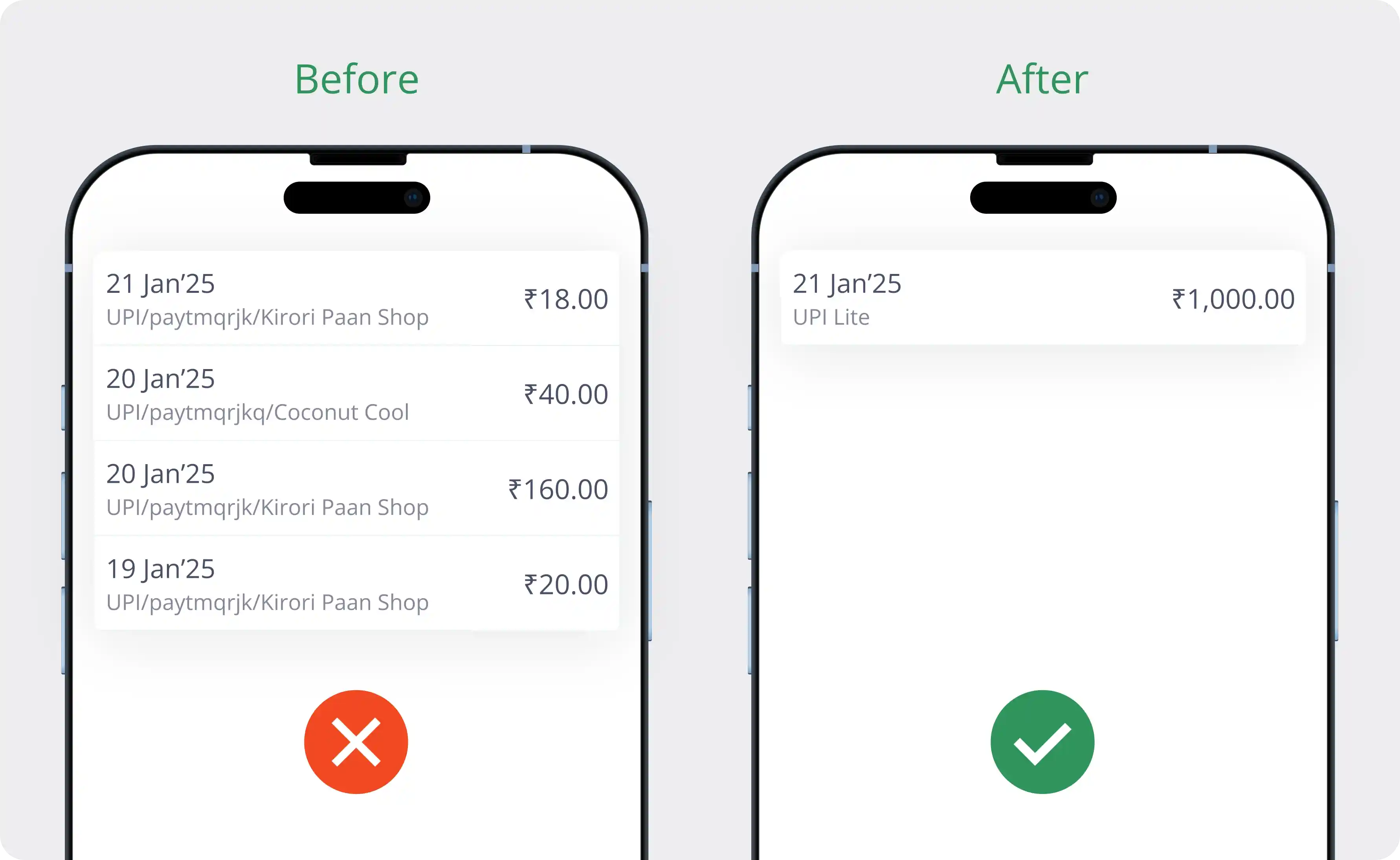

4. De-Cluttered Bank Statements:Small transactions often flood bank statements, making them harder to track. With UPI Lite, these transactions are consolidated, keeping your statement clean and organized.

5. Higher transaction Limits :One of the key benefits of UPI Lite is the higher transaction limits: ₹5,000 wallet balance, ₹1,000 per transaction, and ₹4,000 daily limit.

6. Effortless Everyday Payments:Whether you’re buying groceries, grabbing a quick snack, or paying for your commute, UPI Lite makes frequent, low-value payments simple, quick, and stress-free.

While UPI Lite has its perks, it is important to note that since a transaction does not require UPI PIN to authorize a payment, this safety concern might worry some users. However, UPI Lite runs on the existing UPI ecosystem only which makes it a safe network and with limits on transaction amount, it can be used by users for their convenience!

Who would have thought earlier that a digital payment could be done with my phone’s UPI app so seamlessly! In essence, UPI Lite is a game-changer for managing small-value transactions, offering a convenient payment experience. With features like offline payments and no need for a UPI PIN for small transactions, it simplifies everyday payments. UPI Lite is easy to activate and enhances your banking experience by keeping transaction records organized. It's a smart choice for anyone looking to streamline their daily financial activities.