Want to optimize how you manage Fuel payments with your Driver partners?

With Cotodel, we want to change how Fuel Spends are done and help bring savings to your business!

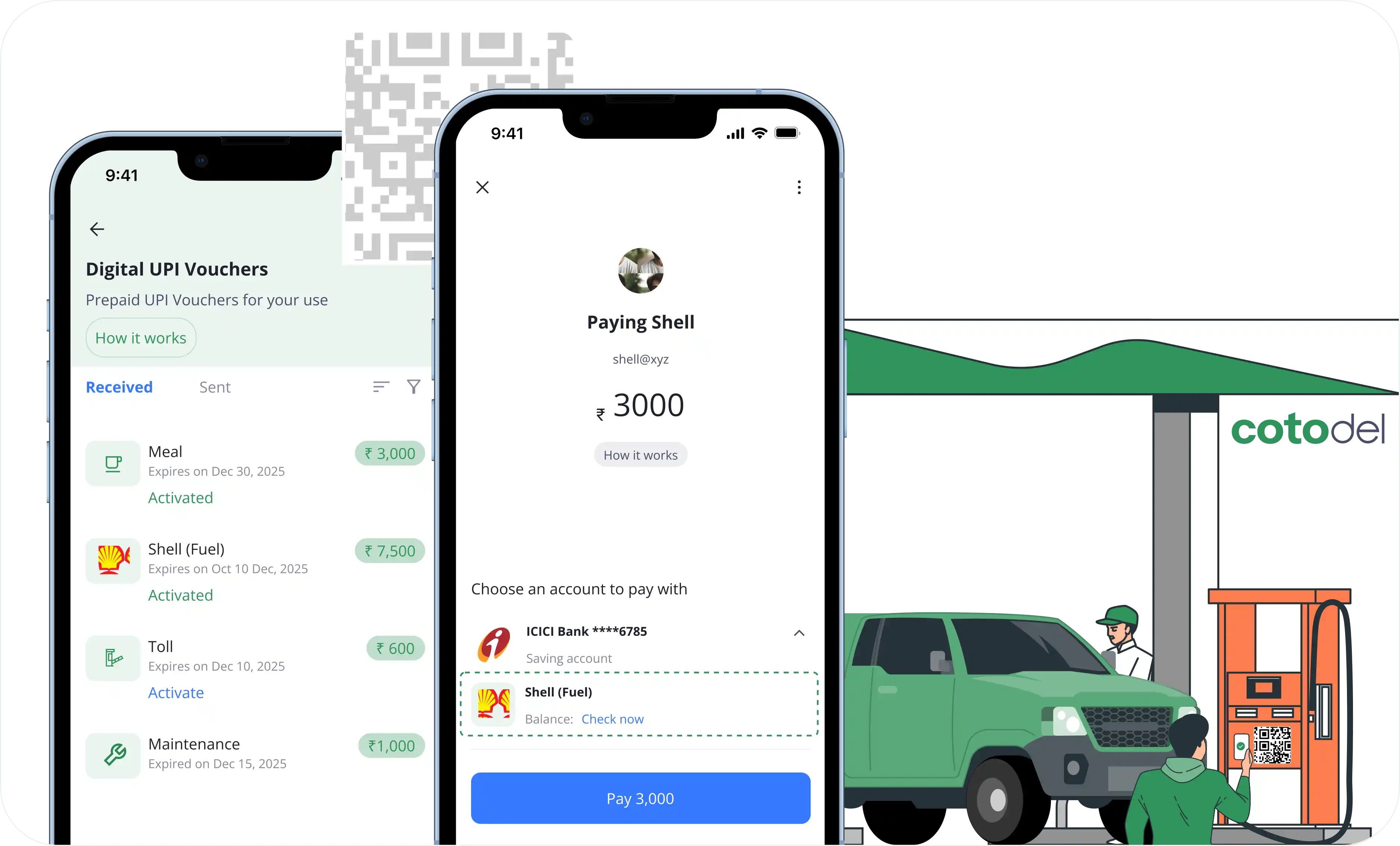

Give your fleet drivers UPI-enabled digital vouchers which can be either locked at all Petrol pumps or even at a specific branded petrol pump of your choice. Another added advantage is that these vouchers can be issued instantly to each driver’s mobile number without any onboarding documents or KYC needed from them!

There is no change in both Consumer as well as Merchant behaviour from their regular UPI transaction which they are anyway doing currently for their personal spends. The issued voucher automatically pops up on the consumer’s existing UPI apps once a relevant merchant QR code is scanned. All you have to do is select the payment instrument as the voucher instead of your Bank Account or Card and make the payment from the issued voucher. The merchant also accepts direct debit transactions on the same QR codes which are already installed at their outlets and do not need to add a new QR code or download any new app for this!

What makes it different from a regular UPI transaction?

Money never leaves your Bank Account till the time the transaction is done by the driver at the Petrol pump! The voucher amount gets blocked in your account and gets deducted once the actual transaction is done.

Fuel Expenses Simplified!

Join Bharat's smartest payments platform to manage & save on your Fleet’s Fuel Expenses!

Let us understand this with an example!

For example, if you want to issue a generic fuel voucher to your driver Raghu, then you will have the option to either restrict the redemption across all Fuel Stations or across Bharat Petroleum Fuel Station or Bharat Petroleum Fuel Station, Indirapuram location.

The vouchers can be multi-redeemable and come with a time validity of up to 1 year. As soon as the driver scans a QR code of a Petrol pump and makes the transaction from their UPI app, the business admin receives all the information digitally, be it merchant details, time of transaction, transaction amount!

How can you issue & redeem this UPI voucher?

Benefits of UPI Voucher

All your spends in 1 platform

Nationwide Discounts

Prevents Fuel Theft & Fraud

Custom control

Maximum visibility

What makes Cotodel better than Fuel Cards?

Yes, Fuel cards do exist through which the purpose of the spend done can be locked but the entire shift is of the Form Factor of payment! All of us have become so used to making transactions from our UPI apps on our mobile phones directly which eliminates the need to carry physical cards or download a new app to do spends via a digital card.

The redemption network of QR codes vs POS machines accepting card payments is heavily in favour of QR codes which are omni-present even at the smallest of petrol pumps these days. It is a direct debit payment acceptance for the petrol pump owner and the driver need not find an ATM machine or a working card machine to fill petrol in their truck/car/bike/auto!

With Cotodel, a beneficiaries KYC is not needed as all vouchers get issued to their mobile number which is already linked to the existing UPI apps installed on the driver’s phone. Any driver, who may be a part-time or contractual employee can also get onboarded seamlessly without any processes or joining fees.

So, let us make your Business spends as seamless as your personal UPI spends!

FAQs