Paras Gupta

Modern fleet management goes far beyond simply tracking vehicles. Fleet aggregators must control fuel and maintenance expenses, automate fleet payments, and ensure a clear digital audit trail for every transaction. Today’s fleet management solutions need control and efficiency for their operational payments as well and should be able to help aggregators operate more efficiently, cut costs, and scale their operations with confidence.

Fleet management is the backbone of a profitable transportation operation — covering vehicle tracking, maintenance scheduling, compliance adherence, and strict fleet expense control. Without a digital system, fleet aggregators often encounter fuel leaks, cash mishandling by drivers, and missed cost-saving opportunities.

A centralized digital fleet management solution automates expense tracking, improves transparency, and secures an audit trail — empowering aggregators to grow smarter and stay competitive in an extremely competitive domestic market. Further, the fleet expense management solution is applicable to all types of vehicles - be it trucks, buses, cars, bikes or autos!

In today’s connected environment, manual fuel receipts and driver cash reimbursements are outdated and ineffective practices. Fleet aggregators now deploy digital payment systems — such as fleet cards and mobile wallets — to automatically capture each fuel or maintenance transaction, complete with time, location, and vehicle ID.

This real-time visibility helps control fleet spending, detect inefficiencies, and eliminate fraud — ensuring that every rupee is correctly utilized and accounted for. Controlling this spend has become important because for a trip, fuel costs account for at least 65% of the trip expenses. If you combine this with tolls and maintenance, it goes as high as 90% for every trip!

Manual fleet expense tracking causes errors, overspending, fraud, and delays in driver reimbursements. Fleet managers and owners want to ensure that the money given for fuel should be spent on fuel only and this is a major concern between the owner and the driver partner.

With digital fleet management, every transaction is automatically linked to the driver and vehicle, with suspicious activity instantly flagged — drastically reducing administrative effort. Fraud risks like unauthorized fuel purchases, card misuse or money being spent on something else by the driver can be minimized using transaction controls, and real-time notifications.

By automating expense tracking, aggregators not only save hours of manual reconciliation but also safeguard their fleets while scaling operations smoothly.

18 billion UPI transactions are happening every month! Time to get your Business payments on UPI as well?

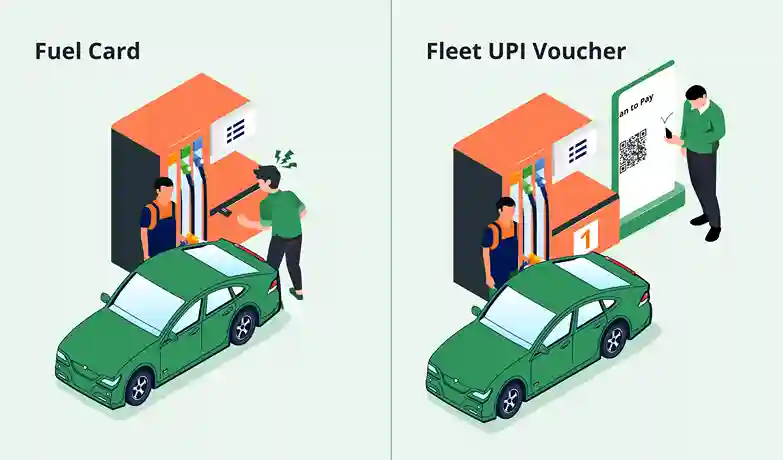

Fleet cards are transforming how aggregators manage operational expenses. Drivers use these cards to directly pay for authorized expenses like fuel, vehicle maintenance, tolls, and parking — with every transaction automatically captured in the fleet management system.

1. Fuel Card:Restricted to fuel purchases only.

2. Fleet Card:Covers a wider range of fleet-related expenses (fuel, repairs, tolls, parking, and more).

The key advantage of using UPI Digital vouchers for your fleet expenses lies in the control they provide:

This gives the fleet owners and managers access to detailed digital reports — giving aggregators full transparency without the paperwork hassle.

Modern fleet management platforms don't just record expenses — they deliver critical insights. Aggregators can track KPIs like:

Dashboards and reports reveal hidden trends, catch leaks early, and help make smarter decisions regarding fleet size, maintenance schedules, and driver behavior. When fleet expense management is digitized, auditing becomes faster, regulatory compliance becomes easier, and financial transparency becomes a core strength — not a bottleneck.

When choosing a modern fleet expense solution, ease of usage is critical. Look for smart options like Cotodel’s Digital UPI Vouchers, which seamlessly integrate into existing UPI apps that drivers already use which leads to no need for extra apps or complex setups. The right solution should be truly hassle-free: for example, Cotodel allows you to onboard new drivers instantly without requiring KYC, making fleet expansion smooth and frictionless. This allows you to add temporary or contractual drivers seamlessly by issuing UPI Digital vouchers on their mobile numbers.

Security is also essential — Cotodel’s system keeps the money safely frozen in your company’s bank account until it's spent, meaning your funds are always under your control and never leave your custody. On top of that, you get access to real-time analytics with no hidden costs involved.

Today, running a smart fleet isn’t just about issuing prepaid fuel cards — it’s about adopting UPI-enabled smart solutions that offer flexibility, security, and complete visibility for your fleet operations. Our business spends should also be as seamless as our personal spends on UPI and that is what Cotodel wants to solve for your fleet!